Sales Tax for LearnDash is an easy way to implement IP location-based sales tax for your courses and groups in LearnDash.

Before we get started a couple of things you should note:

- There is no evidence of location tracked for sales tax. If you are in Europe you may need to use tax system that has more advanced features like WooCommerce.

- IP based location tracking is not full proof. While it works as it should, if your end-user is using a VPN (virtual private network) or similar and masking their location then they may be charged sales tax for a different country.

How does Sales Tax For LearnDash work?

Step 1: Set up your tax rates

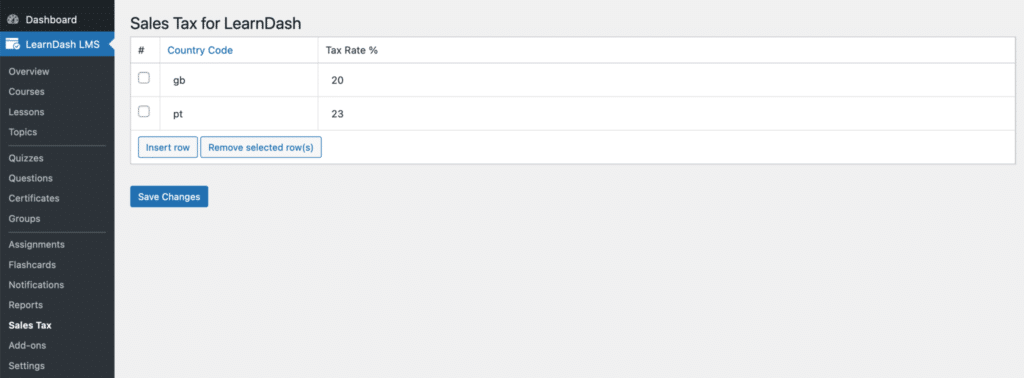

In your wp-admin > LearnDash LMS > Sales Tax you’ll see a table like this:

But how exactly does it work?

- Click “Insert row” which creates a blank row in the table.

- Enter the country code of where you want to charge sales tax. This is a two-letter country code, for example pt = Portugal. GB = United Kingdom and so on.

- Enter the relevant tax rate for the country.

- Once done, click save changes.

Now when the user goes to view your course page the sales tax will be automatically calculated and added to the price or group you set in LearnDash. No extra configuration is needed from you.